How to Use Price Transparency Tools to Compare Drug Costs

Jan, 27 2026

Jan, 27 2026

Buying prescription drugs shouldn’t feel like playing a guessing game. One pharmacy charges $450 for your monthly medication. Another down the street asks for $89. Same pill. Same dosage. Same insurance. What’s going on? The answer is simple: price transparency tools exist to help you see the real cost before you pay.

Since 2024, federal rules have forced insurers and pharmacies to show you what you’ll actually pay - not just the list price. These tools aren’t just for big corporations or wealthy patients. They’re for anyone who’s ever stared at a pharmacy receipt and wondered, "How did this get so expensive?"

Why Drug Prices Vary So Much

Drug prices aren’t set by the government or even the manufacturer alone. They’re negotiated between your insurance company, the pharmacy, and sometimes a middleman called a pharmacy benefits manager (PBM). That’s why two identical prescriptions can cost wildly different amounts.

For example, a 30-day supply of metformin might cost $5 at CVS if your plan has a deal with them, but $87 at Walgreens if they don’t. That’s not a typo. It’s normal. Without tools to compare, you’re stuck paying whatever the first pharmacy tells you.

Studies show that patients who use these tools can cut their drug bills by 15-20%. Some save over $2,000 a year just by switching pharmacies. One user on Reddit saved $287 on blood thinner apixaban by checking prices before picking it up. Another slashed their annual medication spending from $1,850 to $620 using Optum Rx.

What Price Transparency Tools Actually Do

These tools pull data from your insurance plan, pharmacies, and drug manufacturers to show you real out-of-pocket costs. They don’t just list prices - they show what you’ll pay after your deductible, copay, and coinsurance are applied.

Most tools let you:

- Enter your drug name, dose, and quantity

- See prices from nearby pharmacies (usually within 10 miles)

- Compare your insurance-covered cost vs. cash price

- Find cheaper generic or alternative medications

- Get alerts when a better deal becomes available

Some even suggest therapeutic alternatives - like switching from a brand-name statin to a generic version that works just as well but costs 70% less. You don’t need to be a pharmacist to use them. Most are designed like shopping apps: simple, fast, and visual.

Top Tools You Can Use Right Now

Not all tools are created equal. Here are the most reliable ones, based on user feedback and independent reviews:

Rx Savings Solutions (RxSS)

This is the most effective tool for finding lower-cost drug alternatives. It’s integrated into the systems of 18 of the top 25 pharmacy benefits managers. If your employer or insurer uses one of them, you probably already have access. RxSS doesn’t just show prices - it suggests cheaper drugs that your doctor can switch you to with one click. A 2023 case study found it identified cost-saving options for 83% of users.

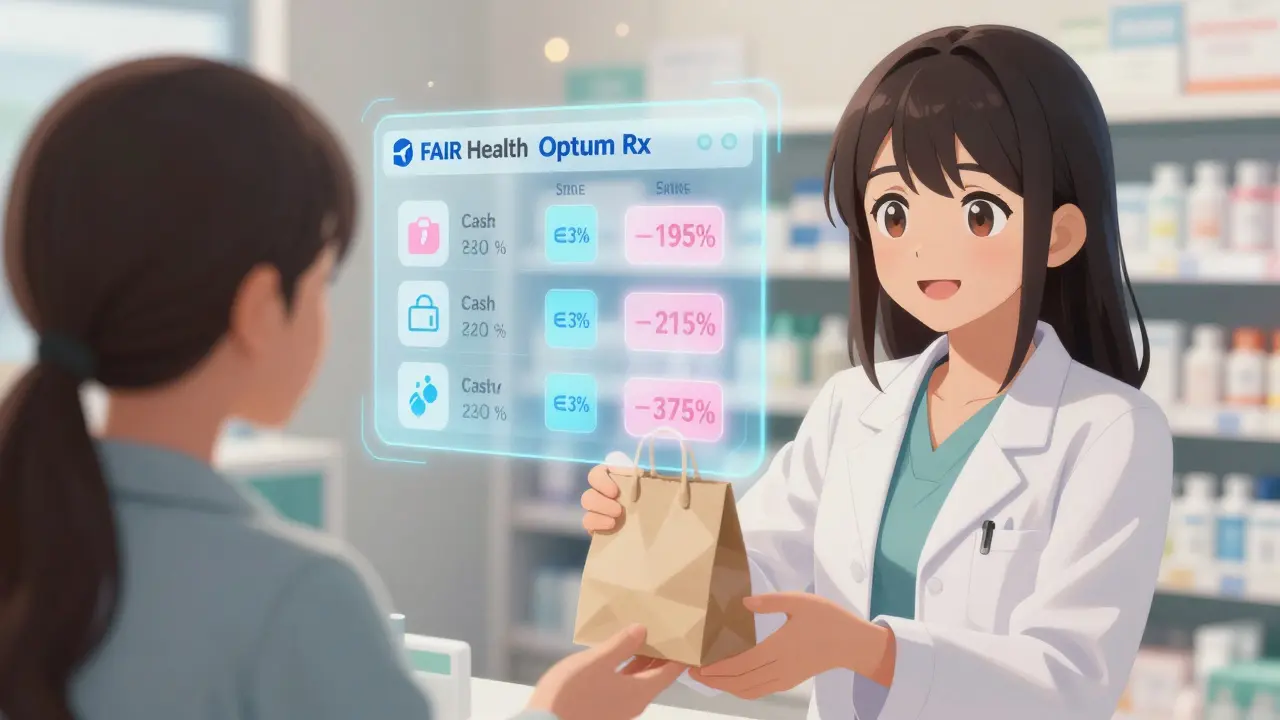

Optum Rx

Used by major insurers like UnitedHealthcare and Aetna, Optum Rx gives you accurate, plan-specific pricing. You’ll need to log in through your insurer’s portal (often labeled "Go to Optum Rx"). It shows real-time prices for your exact coverage, including copays and deductible progress. It’s not flashy, but it’s accurate. Users rate it 4.3 out of 5 stars.

Healthcare Bluebook

Best known for comparing medical procedures like MRIs and colonoscopies, Healthcare Bluebook also covers over 4,000 prescriptions. It shows a "Fair Price™" - what most people pay for the same service in your area. One patient found a $4,200 MRI bill cut to $450 using this tool. It’s free to use and doesn’t require insurance login.

FAIR Health Consumer

This is a government-backed tool that doesn’t need your insurance details. Just enter your drug name and zip code. It pulls data from millions of claims to show average out-of-pocket costs. It’s great for people without insurance or those on high-deductible plans.

Turquoise Health

Used by hospitals and insurers, Turquoise Health lets you filter by drug, location, insurance, and even pharmacy chain. It’s more detailed than consumer apps, but still easy to use. Over 1.2 million pricing queries are run on it every month.

How to Use These Tools - Step by Step

Using these tools isn’t complicated. Here’s how to get started:

- Check if your insurer offers a built-in tool. 78% of large employers now include one. Log into your insurance portal and look for "Drug Pricing," "Cost Estimator," or "Optum Rx."

- Enter your exact prescription. Type in the full name, dose (like 10 mg), and quantity (30-day, 90-day, etc.). Don’t guess - accuracy matters.

- Compare prices across pharmacies. Look at CVS, Walgreens, Walmart, and local independent pharmacies. Some local shops offer cheaper cash prices than big chains.

- Check for alternatives. If the tool suggests a generic or different brand, ask your doctor if it’s safe to switch. Many alternatives work just as well.

- Call the pharmacy before you go. Prices can change. Confirm the final cost over the phone. Some tools don’t include discount programs like GoodRx, so ask if the pharmacy accepts them.

Most people take 15-20 minutes for their first search. After three tries, it takes under 7 minutes. The time you save is worth it - especially when you’re saving hundreds.

What These Tools Don’t Tell You

They’re powerful, but not perfect. Here’s what to watch out for:

- List price vs. actual cost. Some tools show the manufacturer’s list price - not what you pay. Always look for "your cost" or "out-of-pocket."

- Insurance login issues. If you can’t log in, use FAIR Health or Healthcare Bluebook instead. They work without credentials.

- Specialty drugs. Medications for cancer, MS, or rare diseases often require prior authorization. Tools may not show accurate prices until the insurer approves them.

- Discount cards. Tools like GoodRx or SingleCare aren’t always integrated. Always check them separately - they can cut prices even further.

- Timing. If your insurance processes claims slowly, the price you see online might not match what you pay at the counter. Wait 24-48 hours after a plan change.

A 2024 Consumer Reports investigation found that 38% of users were confused by the difference between list price and what they actually owed. That’s why calling the pharmacy is still the final step.

What’s Changing in 2025 and Beyond

Price transparency isn’t slowing down. By 2026, the Congressional Budget Office estimates consumers will save $18.7 billion a year just from using these tools. New rules require:

- All drug manufacturers to report price hikes for drugs over $100/month (Senate bill pending)

- Insurance tools to include quality ratings alongside prices (CMS mandate for 2025)

- Blockchain verification of pricing data to reduce errors

Companies like Clarify Health are testing AI that predicts your future drug costs based on your history. Imagine getting a text: "Your insulin will cost $42 next month - switch to this generic and save $18." That’s coming soon.

Meanwhile, the Alliance for Transparent Drug Pricing - launched in May 2024 with giants like UnitedHealthcare and Express Scripts - is pushing for standardized pricing displays. No more confusing jargon. Just clear numbers.

What You Can Do Today

You don’t need to wait for perfect tools. Start now:

- Use FAIR Health or Healthcare Bluebook to check your most expensive prescription.

- Ask your pharmacist if they accept GoodRx or SingleCare.

- Request a generic version if your drug isn’t one already.

- Set a reminder to check prices every 3 months - prices change often.

Every time you compare prices, you’re not just saving money. You’re pushing the system to be fairer. The more people use these tools, the harder it becomes for pharmacies and insurers to hide inflated prices.

Don’t assume your current pharmacy is the cheapest. Don’t assume your doctor knows the cost. Don’t assume you have no control. You do. And tools like these put that power back in your hands.

Are price transparency tools free to use?

Yes. Tools like FAIR Health, Healthcare Bluebook, and Rx Savings Solutions are completely free. Even those built into your insurance plan don’t charge extra. You’re just accessing data your insurer is legally required to provide.

Do I need my insurance login to use these tools?

Not always. Tools like FAIR Health and Healthcare Bluebook work without logging in. But if you want accurate out-of-pocket costs based on your specific plan, you’ll need to log in through your insurer’s portal. If you can’t log in, use the free tools and call your pharmacy to confirm.

Can these tools help with specialty medications?

They can, but with limits. Specialty drugs often require prior authorization, and prices may not appear until the insurer approves them. Still, tools like Rx Savings Solutions can suggest cheaper alternatives that your doctor might prescribe instead. Always check with your pharmacy or insurer if you’re unsure.

Why does the price change between the tool and the pharmacy counter?

A few reasons: insurance claims may not be processed yet, discount programs like GoodRx weren’t applied, or the pharmacy updated prices after the tool last refreshed. Always call the pharmacy before picking up your prescription to confirm the final cost.

Are generic drugs as effective as brand-name ones?

Yes. The FDA requires generics to have the same active ingredients, strength, dosage, and effectiveness as brand-name drugs. The only differences are in inactive ingredients (like fillers) and packaging. Most doctors agree generics are just as safe and effective - and often 70-90% cheaper.

Can I use these tools if I don’t have insurance?

Absolutely. FAIR Health and Healthcare Bluebook show cash prices for people without insurance. You can also combine these with discount cards like GoodRx to get the lowest possible price. Many pharmacies offer cash discounts that beat insurance rates.

Next Steps

If you’re on a monthly medication, do this today: Open FAIR Health or Healthcare Bluebook. Type in your drug name. Compare prices at three pharmacies. Call the cheapest one. Ask if they accept GoodRx. That’s it. You’ve just taken control.

Next month, check again. Prices shift. New deals appear. Your savings grow. This isn’t a one-time trick - it’s a habit that saves thousands over time.

And if your employer doesn’t offer a price tool yet? Ask them. Demand it. The more people use these tools, the more pressure there is to make them better - and more widely available.

Katie Mccreary

January 28, 2026 AT 23:25SRI GUNTORO

January 30, 2026 AT 17:15Kevin Kennett

January 31, 2026 AT 09:46Jess Bevis

February 1, 2026 AT 17:25Rhiannon Bosse

February 3, 2026 AT 00:55Linda O'neil

February 3, 2026 AT 13:00Phil Davis

February 5, 2026 AT 04:17Irebami Soyinka

February 5, 2026 AT 06:49Howard Esakov

February 5, 2026 AT 12:21Bryan Fracchia

February 7, 2026 AT 02:49fiona vaz

February 8, 2026 AT 00:40Sue Latham

February 9, 2026 AT 10:23Lexi Karuzis

February 10, 2026 AT 12:19Brittany Fiddes

February 11, 2026 AT 20:28